Bank Advice Note – What is it and what are the requirements

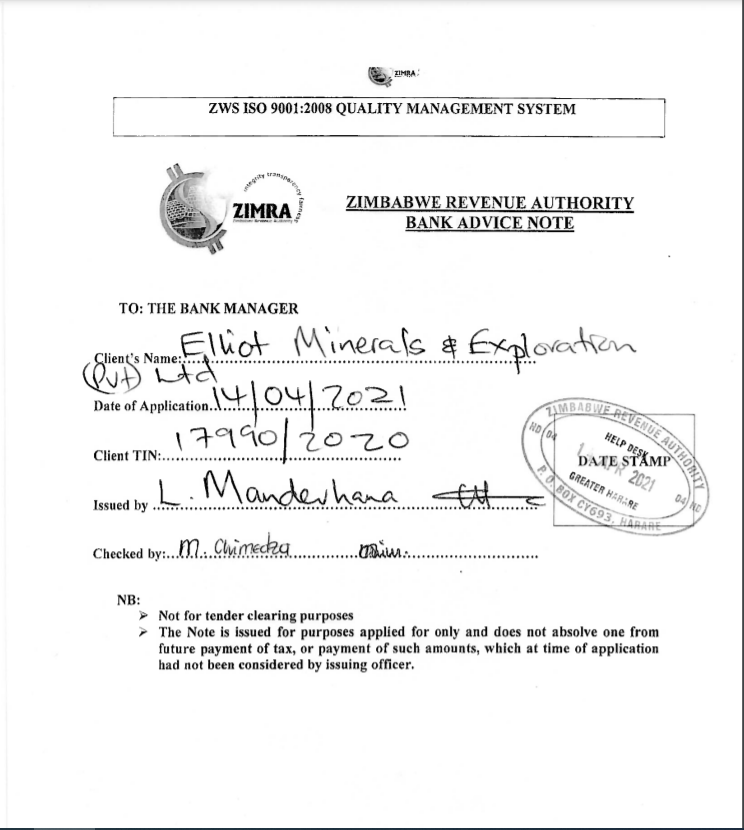

The bank advice note is the first step in getting a corporate bank account for the purposes of getting a ZIMRA Tax Clearance Certificate. The purpose of the bank advice note is to inform bankers of your company’s name, location, and directors.

The process of getting a bank advice note

1. Register your company

The first step in your new account is to register a company. We can take care of that for you. Contact us here for assistance with company registration. This way you will automatically be able to comply with local regulations and start the process.

Apply for a bank advice note

Apply for a bank advice note. According to Zimbabwean law, you need to have a tax clearance certificate to open a company bank account. Since it’s not possible to get tax clearance without a bank account, the tax authority, therefore, makes a special authorization to the bank that allows for new companies to be able to open a business account without tax clearance. This is what is called a bank advice note or simply a bank opening letter. The process requires your original company papers.

What to do after obtaining a bank advice note?

The next step is to visit your bank account with the bank opening letter or bank advice note and the bank account opening requirements below…

Bank account opening requirements

The requirements for opening a company bank account in Zimbabwe differ from bank to bank but these are the general requirements:

- Memorandum and articles of association (applicable to Private Limited Companies only).

- Certificate of incorporation (applicable to Private Limited Companies only).

- CR14 (applicable to Private Limited Companies only).

- CR6 (applicable to Private Limited Companies only).

- Incorporation statement (only applicable to Private Business Corporations).

- Directors’ ID’s and proof of residence in the form of a utility bill like water, phone or electricity bill.

- Passport size photos.

We recommend using BancABC, CBZ, Agribank or Nedbank if you’re in Zimbabwe.

Do an initial deposit

Once you have your bank account available, you need to pay the initial deposit in order to activate your account.

Conclusion

There are three main steps in order to set up a new bank account: registering your company, getting a bank advice note, and finally, opening the corporate bank account then a tax clearance certificate. It is important to note that bank accounts can be used for numerous purposes, including purchasing things online without having to pay cash or wait for wire transfers. The steps may seem very different depending on who you speak with or what bank you are with. But if you understand the process behind each one, you should be able to navigate them successfully no matter which bank you might be working with.

Need a bank advice note, order here: