Billion-dollar business ideas can sometimes come as serious frustrations. In mere words, a business idea may sometimes come flanked in thorns. Billion dollar industries have emerged out of human frustration. Should you have something that’s frustrating you, check how you can come up with a business idea out of that frustration.

We’ve all been there. Stuck in the rain, unable to hail a taxi. Frustrated by complicated software. Annoyed by products that simply don’t meet our needs. But what if those moments of irritation weren’t just fleeting annoyances, but rather sparks of brilliant business ideas?

This is the powerful lesson we can learn from a fascinating series highlighting 10 business ideas that were a result of huma frustration but later turned into billion dollar businesses. These stories remind us that some of the most successful businesses weren’t born out of thin air, but from identifying and solving everyday problems – often the very ones we ourselves experience. Let’s dive into these inspiring examples:

- The Rainy Paris Taxi Problem: The Birth of Uber

Imagine being stuck in the romantic city of Paris, the rain pouring down, desperately trying to find a taxi that never seems to arrive. This was the exact frustration experienced by two individuals (Travis Kalanick and Garrett Camp) who decided to take matters into their own hands. Their action? To build a revolutionary app that allowed people to request a ride directly from their phones. Today, Uber is a global giant, valued at over $150 billion, transforming transportation in countless cities worldwide. It’s a testament to how solving a simple, yet widespread, inconvenience can lead to monumental success.

You may not have to build another Uber in your country. However, find ways of tapping into the already existing taxi business of your city or country. In Zimbabwe, there is no Uber at the time of this publication. InDrive has taken the market with storm and it is promising to stay. Tap into the InDrive value chain by offering services like starting a driving school to train drivers who would like to operate InDrive taxis, car servicing, selling of spare parts or oils or even setting up your own garage. On the otherhand, you may start a competing business like what Tap n Go did. Transport business is still a lucrative business in Zimbabwe and most local entrepreneurs are making it in the kombi business.

Company Registration , Tax Clearance Certificates , Vendor Number, PRAZ Regsitration – Call or WhatsApp +263777069078 | +263716196475

- Saving safely from “Detty December”: the rise of PiggyVest

The end of the year often brings with it a season of celebration and, for many, significant spending. In Nigeria, the term “Detty December” encapsulates this period of vibrant social activity. One woman experienced the common frustration of seeing her hard-earned savings vanish during this time. Her solution? PiggyVest, a digital savings app designed to help users save and even lock their funds securely. This innovative approach to financial discipline resonated deeply, and PiggyVest now boasts over 5 million users, highlighting the power of addressing cultural spending habits with a tech-driven solution.

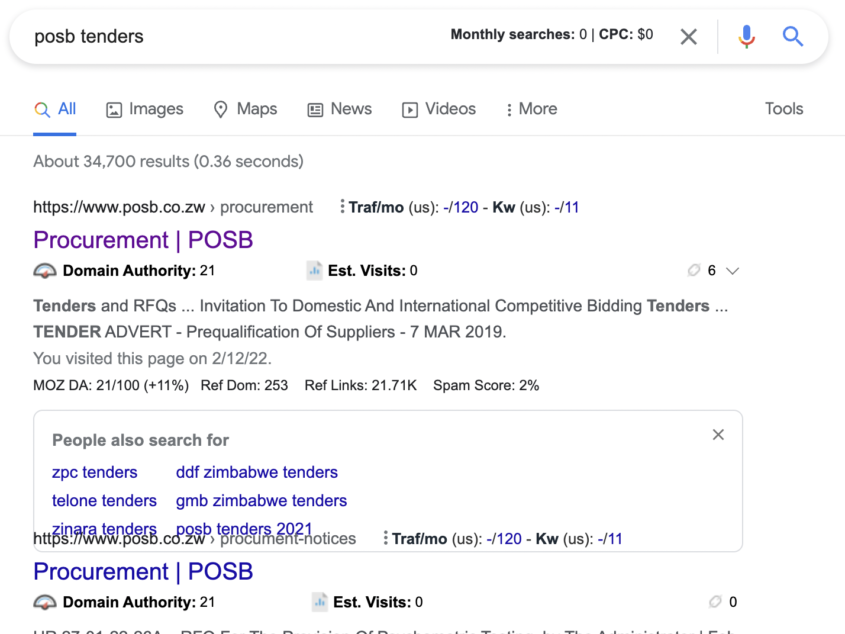

Business ideas of developing a saving mobile application in Zimbabwe are still not yet pursued. That’s a good gap for mobile app developers. You can develop and sell the application or code to local banks or mobile money transfers. It will also be a good idea to just develop the mobile app as part of your portfolio [if you would like to grow your portfolio]. Register your company, apply for tax clearance certificate, a vendor number and start bidding for tenders. Here is a guide to help you on how to apply and win tenders.

- The Airbnb Story: Affordable Accommodation for Conference Guests – the housing business idea

The struggle of affording rent in a bustling city is a reality for many. Three individuals (Brian Chesky, Nathan Blecharcyzk, and Joe Gebbia) facing this very challenge in their apartment had a resourceful idea when a large conference came to town. They offered air mattresses on their floor to attendees who couldn’t find or afford hotel rooms. This simple $40 side hustle evolved into Airbnb, a company now valued at $80 billion, revolutionizing the travel industry by connecting people with unique accommodation options in almost every corner of the globe. It showcases how a need for affordable lodging, coupled with a sharing economy mindset, could disrupt traditional hospitality.

The housing market continues to be a profitable business idea in Zimbabwe due to the housing shortage currently being experienced especially in major cities. According to a recent publication in The Herald, there is a housing gap in Zimbabwe of 1.25million households with 70% of that number being urban centres. The numbers indicate a huge market gap with so many business ideas to tap into. List your unoccupied rooms on Propertybook.co.zw or on Airbnb if you would like to go the Airbnb route. Start a construction company to build houses for the unhoused market.

Company Registration , Tax Clearance Certificates , Vendor Number, PRAZ Regsitration – Call or WhatsApp +263777069078 | +263716196475

- Design for Everyone: The Creation of Canva – an oldage business idea

Business ideas are always engulfed in thorns. Where others see a problem, you must see an opportunity for a business idea. For those without professional graphic design skills, creating visually appealing content can be a significant hurdle. One woman intimately understood this frustration, having struggled with complex software like Photoshop. Her answer was Canva, an incredibly user-friendly design tool that empowers anyone to create stunning visuals for various purposes. With a valuation of $40 billion, Canva has democratized design, proving that simplifying complex processes and making tools accessible to a wider audience can lead to massive adoption and success.

While you may not have to recreate Canva, you can find other lucrative business ideas within the Canva value chain. Offer services like Canva templates design, becoming a social media manager and using Canva for your designs. With advanced features such as cloud storage and the ability of multi users collaborating on one design in real time, Canva so far outweighs main design tools like Photoshop. However, Canva still has a long way to go in improving print quality and adding more flexibility options for designers to show their artistic prowess.

- Consistent Drug Supply in Ghana: The Impact of mPharma

Inconsistent stock levels and fluctuating prices in pharmacies are a major healthcare challenge in many developing countries. Recognizing this critical frustration in Ghana, a visionary individual built mPharma, a platform designed to manage drug supply and inventory efficiently. This innovative solution ensures that essential medicines are more readily available and their prices are more stable. Operating in 9 countries, mPharma demonstrates how addressing systemic issues within vital sectors can create significant impact and a sustainable business.

Business ideas like mPharma are what moves economies and makes lives easier. As an entrepreneur in the health industry, you may find business ideas within the pharmaceuticals value chain. These include but are not limited to: opening a pharmacy , being a supplier of pharmaceutical equipment, wholesaling of clinical products, transportation of lab equipment [bike delivery] , offering software solutions to pharmacies e.g accounting systems, Customer relation management [CRM] software or even partnering with pharmacies as a consultant [doctor, accountant, digital marketer, software developer, lawyer, data analyst]

- The WhatsApp business idea

Remember the days when international phone calls were prohibitively expensive? Jan Koum, unable to easily connect with his family overseas due to these high costs, experienced this frustration firsthand. His response was to develop WhatsApp, an app that allowed users to text each other globally for free, using the internet. This simple yet powerful solution transformed the way people communicate worldwide, ultimately leading to its acquisition by Facebook for a staggering $19 billion. WhatsApp highlights how overcoming communication barriers can connect the world and build immense value.

Businesses that you can start alongside WhatsApp are unlimited! You can be a developer of WhatsApp Cloud APIs , a WhatsApp Business expert offering lessons on how to use WhatsApp Business to SMEs in your country or help businesses develop WhatsApp chatbots that helps smoothen their workflows.

Company Registration , Tax Clearance Certificates , Vendor Number, PRAZ Regsitration – Call or WhatsApp +263777069078 | +263716196475

- Underwear Lines Under White Pants: The Invention of Spanx

A seemingly minor fashion frustration led to a major entrepreneurial success story. Sara Blakely was simply annoyed by visible panty lines under her white pants and the lack of suitable undergarments. Instead of just complaining, she took action and invented Spanx, revolutionary shapewear designed to solve this very problem. Her innovative approach to a common fashion dilemma not only filled a gap in the market but also propelled her to become the youngest self-made female billionaire, proving that even everyday fashion frustrations can be incredibly lucrative.

- Timely Access to Blood in Emergencies: The Lifesaving Innovation of LifeBank

In critical medical situations, access to blood can be a matter of life and death. The tragic reality of hospitals facing shortages and delays in obtaining blood supplies was the core frustration behind LifeBank in Nigeria. This impactful platform was built to deliver blood quickly and efficiently in emergencies. By addressing this urgent healthcare need, LifeBank has not only saved countless lives but also garnered significant recognition and awards, demonstrating how solving crucial societal problems can create both immense value and profound impact.

- Simplifying Online Sales: The Birth of Shopify

For individuals with a product to sell, navigating the complexities of early eCommerce platforms was often a daunting task. One entrepreneur, wanting to sell snowboards online, found the existing options too complicated. His frustration led him to take action and build a better, more user-friendly platform himself. That platform is now Shopify, which powers millions of online stores worldwide, empowering countless entrepreneurs to bring their products to market with ease. Shopify’s success underscores the importance of simplifying complex processes and catering to the needs of online merchants.

Company Registration , Tax Clearance Certificates , Vendor Number, PRAZ Regsitration – Call or WhatsApp +263777069078 | +263716196475

The Underlying Lesson: Turn Annoyances into Business Ideas

These remarkable stories share a common thread: identifying a personal frustration, or a frustration experienced by many, and then taking decisive action to create a solution. As the concluding thought in this inspiring series reminds us: “Everytime something annoys you, that is a business idea.”

So, the next time you find yourself frustrated by something in your daily life, don’t just dismiss it as an inconvenience. Instead, consider it a potential opportunity. Could this be the spark of your own innovative solution? Could your frustration be the seed of your future success? The stories of Uber, PiggyVest, Airbnb, Canva, mPharma, WhatsApp, Spanx, LifeBank, and Shopify certainly suggest that the answer might just be a resounding yes.